Stuttgart, Germany – The Bosch Group increased its sales and result significantly in 2021. According to preliminary figures, total sales rose 10 percent to 78.8 billion euros. After adjusting for exchange-rate effects, sales growth at the supplier of technology and services was 11 percent. Earnings before interest and taxes (EBIT) from operations increased by more than half to reach 3.2 billion euros. The EBIT margin from operations is therefore expected to be around 4 percent, compared with 2.8 percent in the previous year. “Our business performed much better in 2021 than expected,” said Dr. Stefan Hartung, chairman of the board of management of Robert Bosch GmbH, at the presentation of the company’s preliminary business figures. “We were able to exceed our forecasts despite many challenges, such as cost burdens due to supply bottlenecks and price increases for raw materials.” Business success was also significantly shaped by “solidarity in times of social distancing,” as he put it. “I would like to thank our associates for their commitment, and our customers, suppliers, and business partners for their trust,” Hartung said, adding that, together with the global Bosch team, he wanted to continue developing technology that is “Invented for life” as a response to current challenges. “Bosch is a technological pioneer in many areas, and we want to keep it that way.” To this end, the company is continuing to invest large sums in strategically important fields, including a total of around 1 billion euros in microelectronics and electromobility this year alone. At the same time, Bosch is increasingly focusing on partnerships, such as the recently announced alliance with Volkswagen in the field of automated driving.

The Bosch chairman also expects the efforts of many countries to move toward a climate-neutral economy to significantly stimulate growth in the future: “Climate action is driving our business forward – from mobility solutions and industrial automation to building technology and home appliances,” Hartung said. “And thanks to connectivity and artificial intelligence, energy efficiency will continue to improve.” In this vein, Bosch was able to increase its sales of connected power tools, home appliances, and heating systems by 50 percent in 2021 – from 4 million units in 2020 to more than 6 million.

Bosch is stepping up its climate action – growth through electrification

Bosch is committed to the goals of the EU’s Green Deal. Its business sectors are already implementing a broad range of measures to combat global warming: with its 400 locations worldwide, Bosch has been climate neutral since the first quarter of 2020. Between now and 2030, the company plans to cut carbon emissions along its supply chain – from purchasing to product use – by 15 percent. According to the Bosch chairman, electrification is already giving rise to more and more business. “We are generating billions in sales with electromobility. We’re also growing at double-digit rates with heat pumps for the home, and electrical drives are making inroads in industrial technology,” Hartung said. He believes this puts the company in a strong position: “Bosch is translating climate action into growth.” The company is demonstrating how the transformation to climate neutrality can succeed both ecologically and economically, he said.

Sustainable mobility – growth from automotive and industrial technology

Bosch is also tapping further growth potential in electromobility. Since the end of 2021, the company has been manufacturing power semiconductors made of silicon carbide (SiC), which can extend the range of electric vehicles by up to 6 percent. According to the market research company Yole, the SiC market as a whole will grow on average by 30 percent a year to over 2.5 billion dollars over the next three years. Dr. Robert Habeck, the German Federal Minister of Economic Affairs and Climate Action, recently visited Bosch’s Bamberg site to find out more about the mass production of the stationary fuel cell (solid-oxide fuel cell, SOFC). With its SOFC technology, Bosch is playing a role in the transition to renewable energy while opening up new business opportunities. By 2024, the company plans to invest more than 400 million euros in SOFC technology and a further 600 million euros in mobile fuel cells.

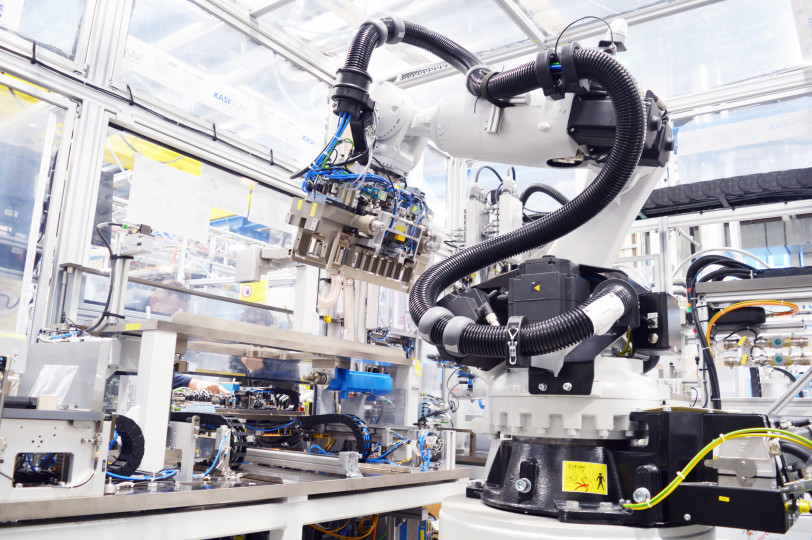

Bosch has also entered the factory equipment business for battery production. This business has potential: according to the company, the global battery market is growing by up to 25 percent annually. Together with Volkswagen, Bosch is looking into jointly making battery cell manufacturing processes ready for volume production. Hartung said: “Our common goal is for a European supplier to be the cost and technology leader in the volume production of battery technology.” Experts see the joint plans as an important step on the road to climate-neutral mobility and the mass production of sustainable batteries.

Software-dominated mobility – double-digit growth in a market worth billions

Bosch also intends to achieve growth and expand its position in software development for vehicles. The Mobility Solutions business sector already equips vehicles worldwide with more than 200 million control units running its proprietary software each year. The company expects the market for automotive software to reach a volume of some 200 billion euros by 2030. “Bosch will see double-digit growth in this market,” said Dr. Markus Heyn, the new chairman of the Mobility Solutions business sector and member of the board of management of Robert Bosch GmbH.

According to Heyn, Bosch has already set the strategic course for this. The company’s portfolio of application-independent vehicle software will be brought together in its ETAS subsidiary in mid-2022. ETAS will offer basic vehicle software, middleware, cloud services, and development tools for universal application. In addition, Bosch’s new Cross-Domain Computing Solutions division will create application-specific vehicle software with special hardware for functions such as driver assistance and automated driving. In this field, Bosch entered into a wide-ranging alliance with Cariad, Volkswagen’s software subsidiary, at the end of January 2022. “Our goal is to accelerate the process of making partially and highly automated driving in everyday vehicles a reality,” Heyn said. “We want to set standards for the market that will benefit other automakers.”

Transforming the industrial workplace – a billion euros earmarked for training

The path toward a climate-neutral economy is also one that Bosch wants to help forge as an employer. “With many industries undergoing a transformation, Bosch sees an opportunity to rethink employment,” said Filiz Albrecht, member of the board of management and director of industrial relations at Robert Bosch GmbH. To support people as they move from one kind of work to another, it is increasingly important for employers to “make prospects for new employment visible outside their own company as well.” That’s why in Germany, Bosch is contributing its broad experience to Allianz der Chancen, a cross-industry initiative concerned with the transformation of the working world. “We believe we can make this change socially acceptable,” Albrecht said. To that end, the company is also pursuing new approaches to associate placement and qualification. Furthermore, Bosch is continually investing in upskilling its workforce – more than a billion euros over the past five years.

Another way the company is driving change in the world of work is with hybrid collaboration models. “With our ‘Smart Work’ initiative, we are systematically shaping the interplay between working remotely and working on site. Together with their supervisors, teams determine the flexible arrangement of when and where they work for themselves,” Albrecht said. Determining their time and place of work is especially important for software developers, and, as Albrecht says, the need for these professionals is great: “In the Cross-Domain Computing Solutions division in Germany alone, we currently have more than 1,000 vacancies for software experts.”

Business development in 2021 – all business sectors increased sales

Not only did the Bosch Group’s total sales grow year on year, but they are also higher than in 2019, the year before the crisis. “The company’s broad diversification across different industries and regions paid off once again,” said Dr. Markus Forschner, member of the board of management and chief financial officer of Robert Bosch GmbH. “All business sectors increased their sales despite global supply bottlenecks.” The Mobility Solutions business sector, which is the largest and generates the highest sales, recorded significant growth, even though the business environment in the fourth quarter put a brake on developments. Sales rose 7.5 percent to 45.4 billion euros despite the chip shortage, which had a particularly major impact on the automotive industry. Adjusted for exchange-rate effects, this is an increase of 7.9 percent. The Industrial Technology business sector benefited particularly from the recovery in the mechanical engineering market and achieved sales of 6.1 billion euros. This is an increase of 20 percent, both in nominal terms and after adjusting for exchange-rate effects. As the CFO pointed out, this meant that sales returned to their pre-crisis level. In the Consumer Goods business sector, products for the home and garden were once again in strong demand. At 21 billion euros, sales were significantly above the previous year’s level. This is a rise of 13 percent; adjusted for exchange-rate effects, it is 15 percent. Sales in the Energy and Building Technology business sector rose 11 percent to 5.9 billion euros – growth of 12 percent after adjusting for exchange-rate effects. To quote Forschner, “The business benefited from strong demand for climate-friendly heating technology, with the business sector actually exceeding its pre-crisis level.”

Business development in 2021 – sales growth in all regions

“Regionally as well, Bosch sales grew across the board,” Forschner said. In Europe, sales grew by 9.3 percent to 41.5 billion euros. After adjusting for exchange-rate effects, this is an increase of 10 percent. In North America, sales came to 11.5 billion euros. The increase in sales of 6.5 percent becomes 10 percent after adjusting for exchange-rate effects. In South America, sales rose to 1.4 billion euros – an increase of 32 percent, or 41 percent after adjusting for exchange-rate effects. “This is a very positive development, especially since the region was hit particularly hard by the coronavirus pandemic the previous year,” Forschner explained. In Asia Pacific, sales grew by 12 percent to 24.4 billion euros – 11 percent after adjusting for exchange-rate effects.

Headcount development in 2021 – slight increase worldwide

As of December 31, 2021, the Bosch Group employs some 401,300 associates worldwide. Most of this increase of some 6,700 related to Asia Pacific and Europe; the number of associates in Germany remained stable at around 131,400. In research and development, the number of associates rose by just under 4 percent to 76,300. The number of software developers worldwide was more than 38,000 – an increase of some 4,000 over the previous year.

Outlook for 2022 – global economy beset by uncertainty

Bosch expects the global economy to grow between 4 and 4.5 percent in 2022, as against some 5.5 percent in 2021. Despite impressive progress made with vaccinations in many countries, the company expects Covid-19 to continue to impose heavy burdens on society and the economy in 2022. In addition, ongoing supply bottlenecks and rising prices for raw materials, primary products, and transportation will have a major impact on the global economy and affect the business of many sectors, especially the automotive industry. The marked rise in inflation in many sectors and regions is also clouding the outlook. Provided the business environment is not disrupted further, the Bosch Group expects to grow its sales in 2022. It also expects to achieve an EBIT margin from operations that is at least on a par with the previous year. Despite these considerable challenges, Forschner remains confident: “Bosch has a sound financial basis for investing in strategically important fields and continuing on its current course.” It remains Bosch’s objective to grow more strongly than the markets in its most important sectors and regions.

Contact persons for press inquiries:

Corporate, business, and financial topics:

Sven Kahn, phone: +49 711 811-6415

Sustainable mobility:

Thorsten Schönfeld, phone: +49 711 811-43378

Connected and automated mobility:

Jörn Ebberg, phone: +49 711 811-26223

Human resources and social welfare:

Simon Schmitt, phone: +49 711 811-6478

Mónika Hack

+36 70 510 5516

The Bosch Group is a leading global supplier of technology and services. It employs roughly 401,300 associates worldwide (as of December 31, 2021). According to preliminary figures, the company generated sales of 78.8 billion euros in 2021. Its operations are divided into four business sectors: Mobility Solutions, Industrial Technology, Consumer Goods, and Energy and Building Technology. As a leading IoT provider, Bosch offers innovative solutions for smart homes, Industry 4.0, and connected mobility. Bosch is pursuing a vision of mobility that is sustainable, safe, and exciting. It uses its expertise in sensor technology, software, and services, as well as its own IoT cloud, to offer its customers connected, cross-domain solutions from a single source. The Bosch Group’s strategic objective is to facilitate connected living with products and solutions that either contain artificial intelligence (AI) or have been developed or manufactured with its help. Bosch improves quality of life worldwide with products and services that are innovative and spark enthusiasm. In short, Bosch creates technology that is “Invented for life.” The Bosch Group comprises Robert Bosch GmbH and its roughly 440 subsidiary and regional companies in some 60 countries. Including sales and service partners, Bosch’s global manufacturing, engineering, and sales network covers nearly every country in the world. With its more than 400 locations worldwide, the Bosch Group has been carbon neutral since the first quarter of 2020. The basis for the company’s future growth is its innovative strength. At 128 locations across the globe, Bosch employs some 76,300 associates in research and development, of which more than 38,000 are software engineers.

The company was set up in Stuttgart in 1886 by Robert Bosch (1861-1942) as “Workshop for Precision Mechanics and Electrical Engineering.” The special ownership structure of Robert Bosch GmbH guarantees the entrepreneurial freedom of the Bosch Group, making it possible for the company to plan over the long term and to undertake significant upfront investments in the safeguarding of its future. Ninety-four percent of the share capital of Robert Bosch GmbH is held by Robert Bosch Stiftung GmbH, a charitable foundation. The remaining shares are held by Robert Bosch GmbH and by a corporation owned by the Bosch family. The majority of voting rights are held by Robert Bosch Industrietreuhand KG, an industrial trust. The entrepreneurial ownership functions are carried out by the trust.

Additional information is available online at www.bosch.hu, iot.boschblog.hu, www.bosch.com, www.iot.bosch.com, www.bosch-press.com, www.twitter.com/BoschPresse