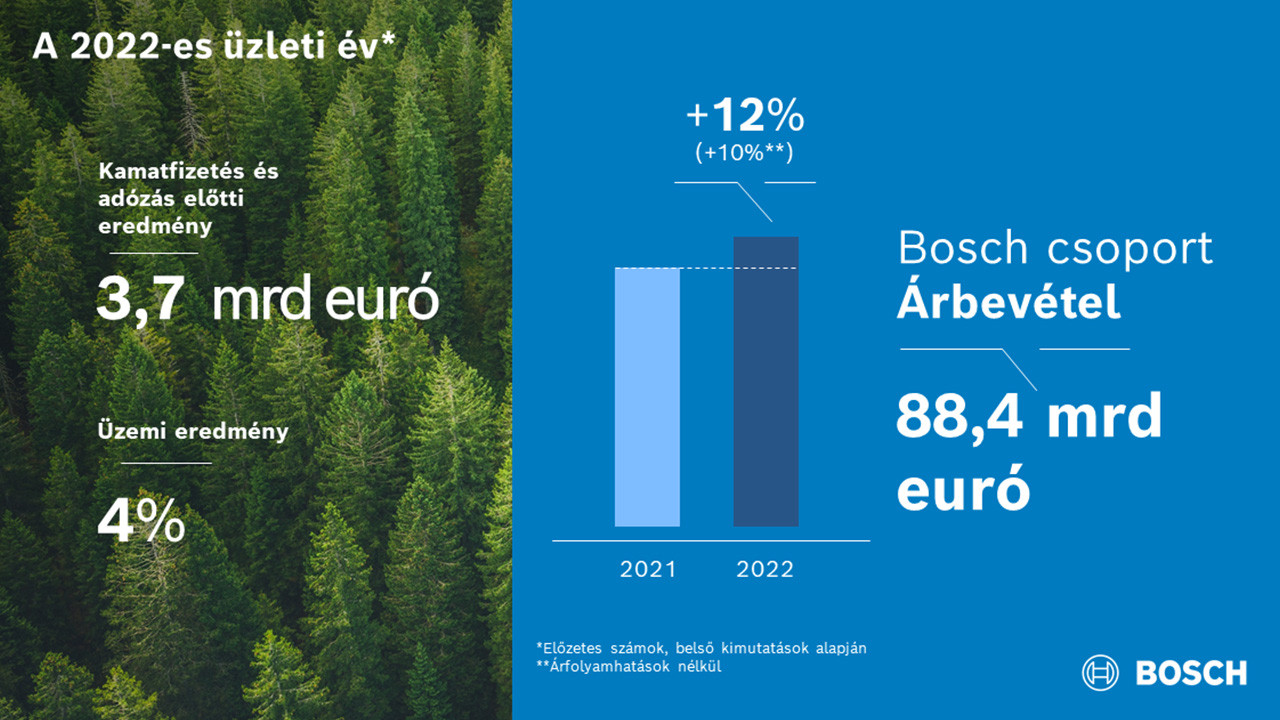

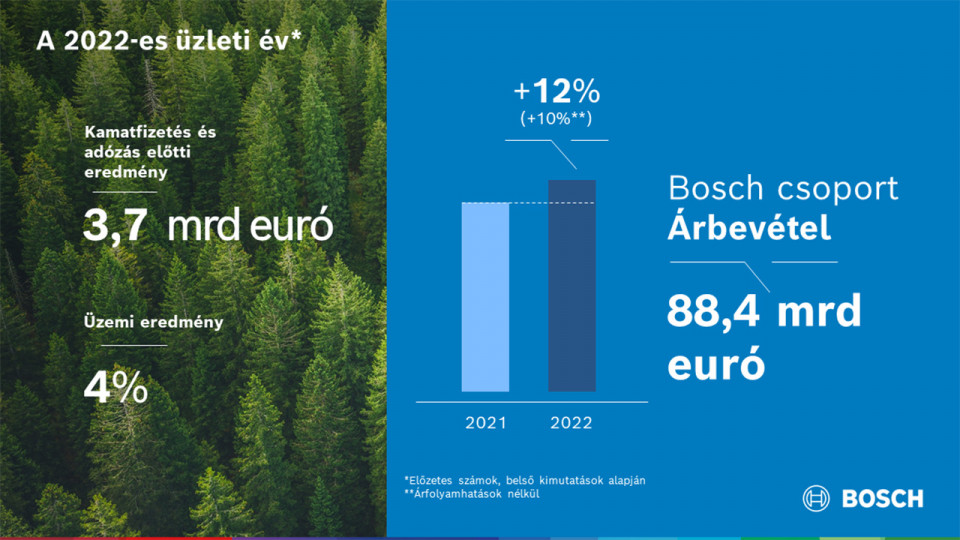

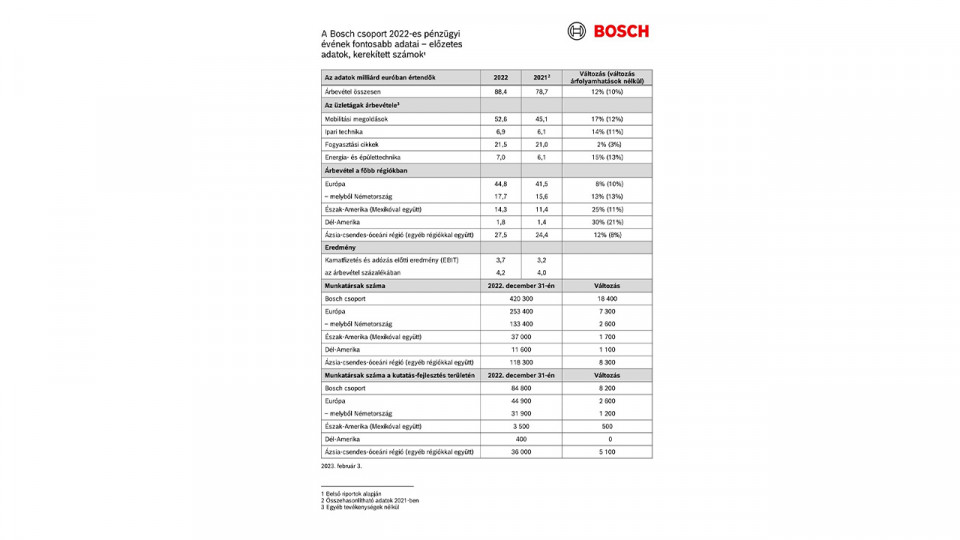

Stuttgart, Germany – Despite the challenging macroeconomic situation, Bosch, the supplier of technology and services, succeeded in increasing sales and result in the 2022 business year. According to preliminary figures1, the Bosch Group generated total sales of 88.4 billion euros. Sales thus increased some 12 percent over the previous year, or around 10 percent after adjusting for exchange-rate effects. EBIT (earnings before interest and taxes) from operations reached 3.7 billion euros. The EBIT margin from operations is expected to be around 4 percent. “The difficult 2022 business year once again demonstrated that Bosch is crisis-proof while possessing tremendous innovative strength,” said Dr. Stefan Hartung, chairman of the board of management of Robert Bosch GmbH, at the presentation of the company’s preliminary business figures. "In an environment that remains challenging, we are securing our growth opportunities worldwide with targeted investments and expanding our international presence. We want to offer people around the world technology that is ‘Invented for life’ and thus make a meaningful contribution to society – from climate-friendly heating to energy saving and sustainable mobility.”

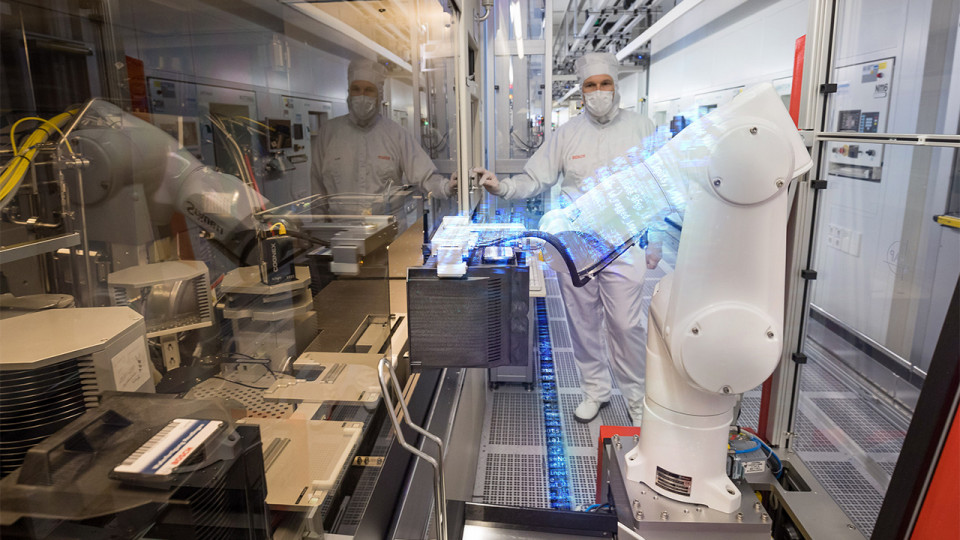

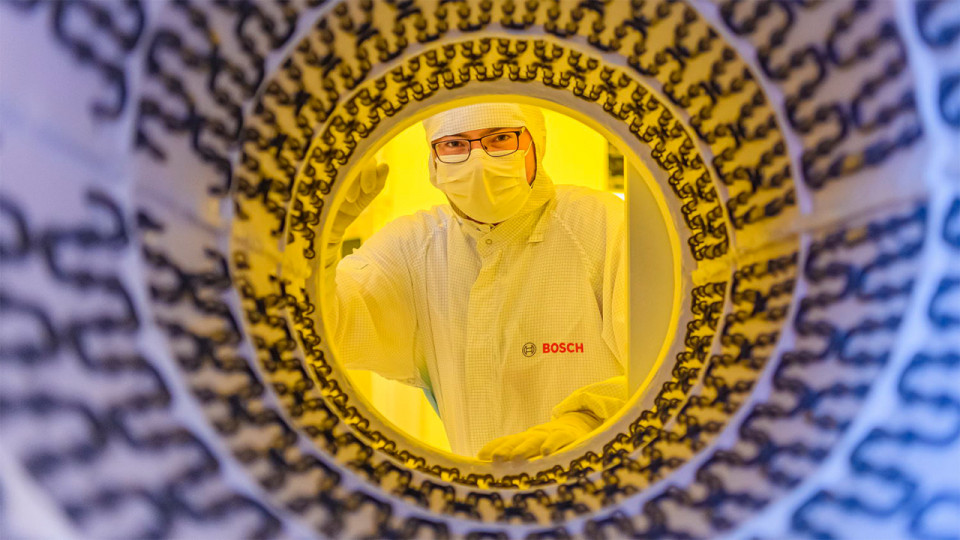

Recently, Bosch announced that some 950 million euros will be invested over ten years in an engineering and manufacturing center in Suzhou, China. The center will create mobility solutions and products in the areas of electrification and automation which are specifically designed to serve local market demand. At the same time, Bosch is helping to boost Europe’s status as a high-tech location: “A prime example is the expansion of our wafer fabs in Dresden and Reutlingen,” Hartung said. “In the years up to 2026, we plan to invest another 3 billion euros in our semiconductor business – also as a contribution to countering chip shortages in the mobility sector.” Bosch also plans to focus more on expanding its business globally, in places including Egypt, India, Mexico, the United States, and Vietnam.

Global trade: collaboration essential for prosperity and climate action

For Bosch, the changes in the market and technology environment being ushered in by connectivity, automation, and electrification in particular, along with the growing importance of sustainability, will serve as growth drivers in the years ahead. Additional demand in emerging regions such as the ASEAN countries will open up further market growth. Against this backdrop, Hartung believes that the company is well positioned with regard to the economic and energy policy situation. However, the energy shortages driving inflation might negatively impact consumption, and thus monetary stability, over the long term. For this reason he welcomed the introduction of a restrictive monetary policy by the central bank. At the same time, he warned against the formation of global economic blocs. “A fragmentation of economic systems threatens innovative strength and prosperity for everyone,” Hartung said. “Most importantly, climate action needs international cooperation.”

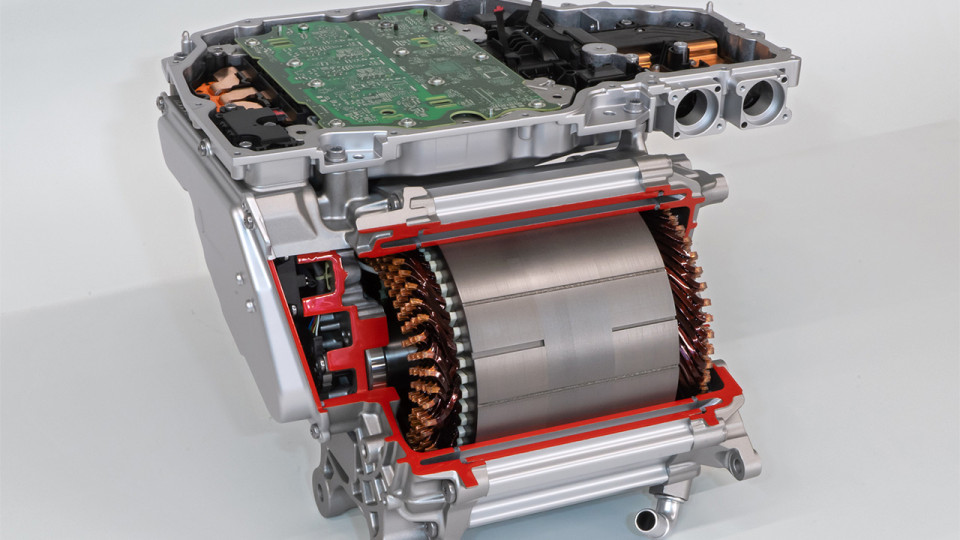

Hartung sees the further development of renewables as a way of resolving the conflicting goals of environmental and economic sustainability. “The transformation of energy systems needs to remain affordable, must not lead to power supply failures in businesses or households, and should leave fossil fuels behind wherever possible.” Bosch is playing its part in this, he said, and upping the pace in fuel-cell and hydrogen technology. “Where electromobility is concerned,” Hartung said, “we are registering a consistently high order intake.” As a result, Bosch expects to register sales of 6 billion euros in this segment by as early as 2026. In China, business with e-axles and motors is already forecast to turn a profit this year.

Climate-neutral technology: energy crisis driving demand

Notwithstanding all the challenges it presents, the energy and climate crisis is increasing global demand for climate-neutral technology. This is opening up a variety of new perspectives for Bosch as well: the company already generates sales of more than 20 billion euros with products for the home. “Our product portfolio can positively influence around 90 percent of energy consumption in the home,” said Dr. Christian Fischer, deputy chairman of the Bosch board of management, who is also responsible for the company’s home and building technology business. “Of this figure, 85 percent relates to heating and hot water and 15 percent to home appliances.” In Germany, Bosch already increased its unit sales of heat pumps by 50 percent in 2022. The European heat-pump market is expected to grow by an annual 25 to 35 percent between now and 2025, and by nearly 40 percent at Bosch, enabling it to gain market share. That is why the company is expanding its manufacturing capacity for heat pumps in Europe: since the beginning of the year, a further production facility has been ramping up in Eibelshausen, Germany. Bosch sees further growth potential in the transformation of energy systems. “However, this transformation must be affordable,” Fischer said. “In buildings, the cost of renovation and retrofitting should not be underestimated.” This explains why Bosch is focusing on hybrid heating systems consisting of heat pump and gas boiler. For the future, the Bosch deputy chairman sees additional potential in the combined optimization of energy flows in vehicles and buildings: “We’re electrifying everything, from bicycles to hydraulics – and we know our way around buildings as well as around cars.”

Employer attractiveness: sustainability attracts skilled workers

Bosch also made progress in implementing its own sustainability and climate targets in the 2022 business year. Over the course of the year, the company increased the share of renewables in its electricity consumption from 89 to 94 percent. “2022 saw us reach nearly half the 1.7 terawatt-hour energy-saving target we have set ourselves for 2030,” said Filiz Albrecht, member of the board of management and director of industrial relations at Robert Bosch GmbH, who is also responsible for sustainability. “At the same time, our commitment to sustainability makes Bosch a more attractive employer.” According to Albrecht, the company’s sustainability strategy is an increasingly important consideration for applicants. In times when skilled workers are in short supply, finding the best talent around the world is also becoming more difficult for Bosch, she said. She pointed out that India is gaining in importance in the competition for software experts. Bosch has 17,000 such associates there, and worldwide their number has risen from 38,000 to 44,000. The need for software developers remains high; the company expects to add around 10,000 by the middle of the decade. “Bosch will soon employ more than 50,000 people in software development,” Albrecht said. The Bosch Group is also developing the digital skills of its assembly-line associates: this year, for example, will see the launch of “LernWerk,” an initiative in the Mobility Solutions business sector. Its initial aim is to improve the skills that will be needed to work in the “factory of the future” at all locations in Germany.

Business developments in 2022: mobility business posts highest sales growth

"Despite semiconductor shortages and a weak economy, all business sectors were able to increase their sales,” said Dr. Markus Forschner, member of the board of management and chief financial officer of Robert Bosch GmbH. At 52.6 billion euros, the biggest business sector, Mobility Solutions, once again generated the highest sales in 2022. The 17 percent increase in sales came to 12 percent after adjusting for exchange-rate effects. “The good news is that our sales thus grew faster than automotive production,” Forschner said. Nonetheless, Bosch cannot be satisfied with its profitability: margins were burdened by cost increases along the entire supply chain as well as upfront investments for the transformation of the company’s mobility business, he said. The Industrial Technology business sector achieved sales growth of 14 percent to 6.9 billion euros. After adjusting for exchange-rate effects, sales growth was 11 percent. According to Forschner, the purchase of HydraForce and the acquisition of Elmo are important milestones for Bosch’s industrial technology business. The Consumer Goods business sector managed to increase sales slightly despite significant consumer reluctance to buy home appliances and power tools, Forschner said. It increased its sales by 2 percent to 21.5 billion euros. After adjusting for exchange-rate effects, this figure rises to 3 percent. In the Energy and Building Technology business sector, on the other hand, growth reflected the unabated high demand for energy-efficient home and building technology. Forschner reported that sales increased to 7 billion euros. After adjusting for exchange-rate effects, the increase of 15 percent amounts to 13 percent.

Business developments in 2022: stronger growth in second half of year

“Encouragingly, all regions increased their sales significantly,” Forschner said. “We saw especially strong growth in the second half of 2022.” In Europe, sales totaled 44.8 billion euros. The 8 percent increase amounts to 10 percent after adjusting for exchange-rate effects. “Growth in Europe was hit harder than the other regions by the war in Ukraine and its consequences,” Forschner said. In North America, sales grew by 25 percent to 14.3 billion euros. The increase amounted to 11 percent after adjusting for exchange-rate effects, which makes it the second-biggest sales increase across all the Bosch Group’s regions. Forschner reported that the development of Bosch’s business with heating and air-conditioning solutions was especially encouraging. In South America, sales totaled 1.8 billion euros. Sales there thus grew faster than in any other region – by 30 percent, or 21 percent after adjusting for exchange-rate effects. As Forschner pointed out, “The strong economy was a key factor in this growth.” In Asia Pacific, sales growth was 12 percent, or 8 percent after adjusting for exchange-rate effects, with sales amounting to 27.5 billion euros. According to Forschner, the region benefited from strong growth in India. By contrast, China’s changes to its Covid-19 policy dampened business developments there at the end of the year.

Headcount development in 2022: Some 18,000 more associates

Worldwide, some 420,300 people worked in the Bosch Group as of the December 31, 2022, reporting date. That is around 18,400 more people than in the previous year, an increase of around 4 percent. Headcount in Germany increased by 2,600 to 133,400. “Nearly half this total growth was among associates in research and development,” Forschner said. The number of associates in this area was 84,800 – of whom 44,000 are software developers.

Outlook for 2023: global economic upswing losing impetus

Bosch anticipates an economic slowdown and expects global economic output to grow by less than 2 percent in the current year. “The global business climate is already reflecting economic burdens,” Forschner said. “Rising interest rates are weighing on investment, especially construction activity and private consumption.” In Europe, this is being compounded by the marked rise in energy costs, even after the recent declines. In China, on the other hand, following the abandonment of its zero-covid policy, a recovery process is likely to begin once the massive infection waves have subsided. According to Forschner, Bosch is feeling an economic slowdown in important sectors and expects to see ongoing cost pressure in value chains. At the same time, a significant amount of capital must be outlaid in order to finance growth in future technologies. “An innovative company like Bosch must make heavy upfront investments,” he said. Over the course of 2023, he went on, Bosch thus aims to increase its sales and further improve its profitability. “We are on course to achieve our long-term target margin of at least 7 percent,” Forschner said. “On these rough economic seas, we’ll maintain a balance – between securing our profitability and financial strength on one hand, and investments and possible acquisitions on the other.”

1 Based on internal reporting; may differ from external figures published later in annual report.

Contact persons for press inquiries:

Hack Mónika, phone: +36 70 510-5516

Corporate, business, and financial topics:

Sven Kahn, phone: +49 711 811-6415, Twitter: @BoschPress

Energy and Building Technology:

Dörthe Warnk, phone: +49 711 811-55508, Twitter: @d_warnk

Sustainable mobility:

Jörn Ebberg, phone: +49 711 811-26223, Twitter: @joernebberg

Human resources and social welfare:

Nora Katharina Lenz-Gaspary, phone: +49 711 811-13315,

Twitter: @BoschPress

Mónika Hack

+36 70 510 5516

The Bosch Group is a leading global supplier of technology and services. It employs roughly 420,000 associates worldwide (as of December 31, 2022). According to preliminary figures, the company generated sales of 88.4 billion euros in 2022. Its operations are divided into four business sectors: Mobility Solutions, Industrial Technology, Consumer Goods, and Energy and Building Technology. As a leading IoT provider, Bosch offers innovative solutions for smart homes, Industry 4.0, and connected mobility. Bosch is pursuing a vision of mobility that is sustainable, safe, and exciting. It uses its expertise in sensor technology, software, and services, as well as its own IoT cloud, to offer its customers connected, cross-domain solutions from a single source. The Bosch Group’s strategic objective is to facilitate connected living with products and solutions that either contain artificial intelligence (AI) or have been developed or manufactured with its help. Bosch improves quality of life worldwide with products and services that are innovative and spark enthusiasm. In short, Bosch creates technology that is “Invented for life.” The Bosch Group comprises Robert Bosch GmbH and its roughly 440 subsidiary and regional companies in some 60 countries. Including sales and service partners, Bosch’s global manufacturing, engineering, and sales network covers nearly every country in the world. With its more than 400 locations worldwide, the Bosch Group has been carbon neutral since the first quarter of 2020. The basis for the company’s future growth is its innovative strength. At 128 locations across the globe, Bosch employs some 85,000 associates in research and development, of which more than 44,000 are software engineers.

The company was set up in Stuttgart in 1886 by Robert Bosch (1861–1942) as “Workshop for Precision Mechanics and Electrical Engineering.” The special ownership structure of Robert Bosch GmbH guarantees the entrepreneurial freedom of the Bosch Group, making it possible for the company to plan over the long term and to undertake significant upfront investments in the safeguarding of its future. Ninety-four percent of the share capital of Robert Bosch GmbH is held by Robert Bosch Stiftung GmbH, a charitable foundation. The remaining shares are held by Robert Bosch GmbH and by a corporation owned by the Bosch family. The majority of voting rights are held by Robert Bosch Industrietreuhand KG, an industrial trust. The entrepreneurial ownership functions are carried out by the trust.

Additional information is available online at www.bosch.hu, iot.boschblog.hu, www.bosch.com, www.iot.bosch.com, www.bosch-press.com, www.twitter.com/BoschPresse