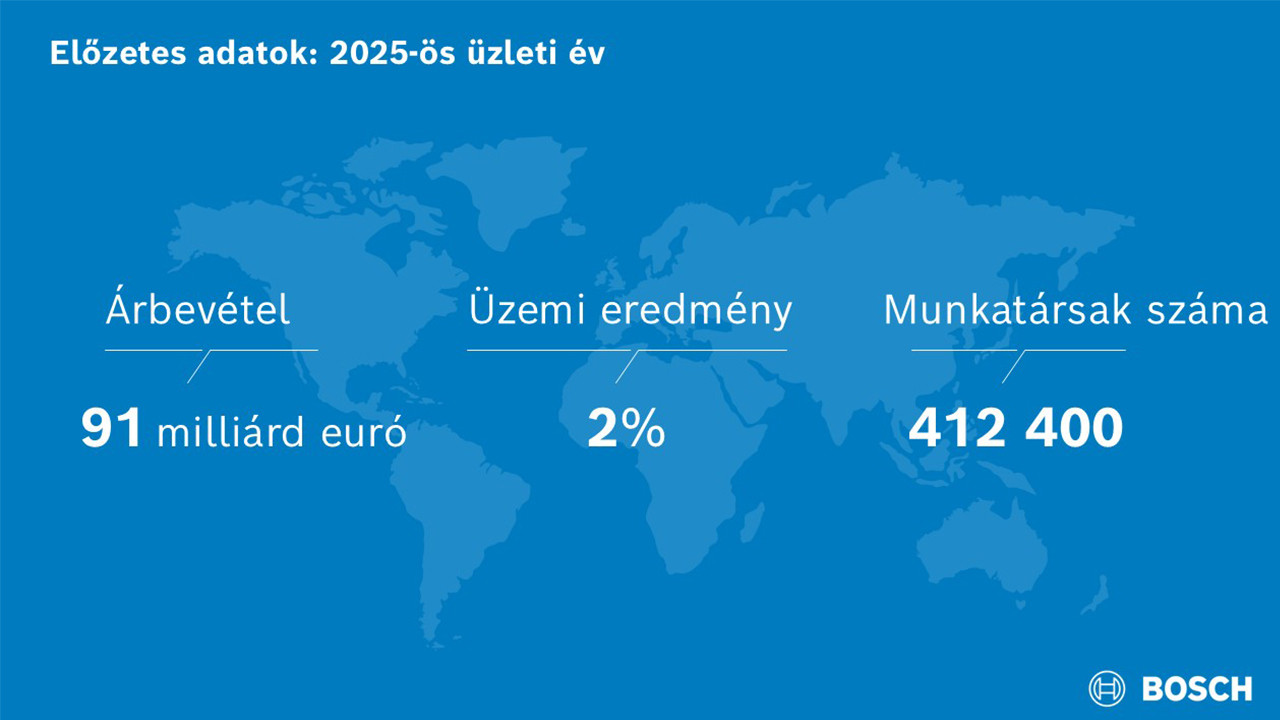

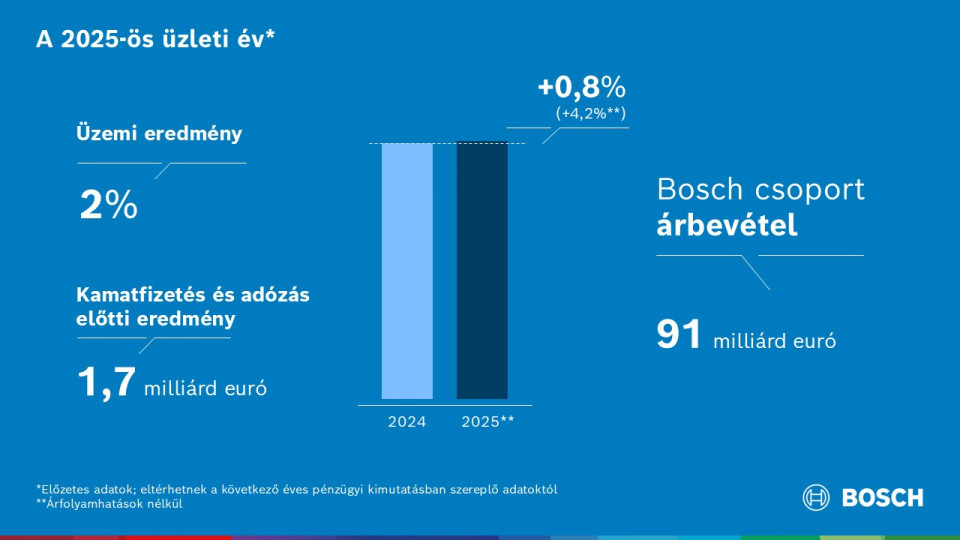

Stuttgart, Germany – Bosch, the supplier of technology and services, can look back on 2025 as an incredibly challenging financial year. According to preliminary figures , sales revenue was up slightly on the previous year’s level at 91 billion euros (2024: 90.3 billion euros). After adjusting for exchange-rate effects, sales revenue grew by 4.2 percent. At around 2 percent, the EBIT margin from operations was below expectations (2024: 3.5 percent). “The economic reality is reflected in our results – 2025 was a difficult and sometimes painful year for Bosch,” said Stefan Hartung, chairman of the board of management of Robert Bosch GmbH, referring to the company’s published preliminary business figures. “In an unfavorable environment, we are continuing to work systematically on our growth strategy, which also requires us to strengthen our competitiveness. We are now setting our course for the future.” According to Hartung, Bosch plans to continue to benefit from its global presence, its strong brand, and its technological expertise. However, the company anticipates increasingly intense competition under adverse economic conditions. Bosch does not expect to see significant improvements in individual markets until 2027.

The main reasons for the sluggish growth in the past financial year were the weak economic environment and the increasingly challenging market conditions. Result was negatively impacted by the lack of margins due to lower sales, as well as by increased tariffs and considerable provisions for necessary structural adjustments and the associated personnel measures. The aim of this restructuring is to ensure that the company remains economically robust, financially independent, and secure for the long term. To achieve this, Bosch still needs to generate annual sales growth of 6 to 8 percent with a margin of at least 7 percent. Given the current environment, the company now assumes that it will begin achieving its target margin of 7 percent in 2027 at the earliest, instead of in 2026.

Competitiveness: Narrow the cost gap, strengthen investment capacity

Bosch continued to systematically pursue its long-term Strategy 2030 over the past year. In addition to achieving the target margin, the strategy stipulates that the company must be one of the three leading providers in its key markets in all regions of the world. This currently requires competitive cost levels and demand-oriented capacities in particular. “We are working hard on our material costs, we are making even more intensive use of AI to increase our productivity, and we are weighing up every investment even more carefully than before,” Hartung said. “And yet, to secure our competitiveness and investment capacity in the long term, we need to do much more to reduce our personnel expenses and streamline our organization.” Above all, the structural shift toward electromobility and the extremely high price and competitive pressure in the global automotive industry is resulting in an annual cost gap of around 2.5 billion euros worldwide in the Mobility business sector alone – in relation to the target margin for the business. As a result, last year Bosch announced it needed to cut about another 13,000 jobs. Hartung emphasized that the board of management was aware of the implications of these decisions and was taking associates’ concerns seriously. “But even a foundation-owned company has to keep an eye on securing its existence and cannot ignore business realities.” He went on to say that Bosch aims to implement these unavoidable measures in close consultation with employee representatives and in as socially acceptable a manner as possible, even if that initially incurs high costs.

Strategy 2030: Innovations and acquisitions will create business opportunities

Despite the adverse environment, Bosch sees great opportunities for a business revival in many market segments. “We assume that market momentum in the crucial field of software-driven mobility will initially be restrained, but will then accelerate significantly, especially in the coming decade,” Hartung explained. The Vehicle Motion Management software for the central control of brakes, steering, powertrain, and chassis is already being very well received on the market, Hartung said. Last year, the supplier of technology and services was able to win customer orders for solutions for automated driving, the requisite sensor technology, and central vehicle computers worth 10 billion euros, and thus hold its own in global competition. The ongoing integration of the newly acquired areas in the HVAC solutions business ensures strong growth prospects: Bosch Home Comfort aims to nearly double its sales revenue to 8 billion euros in the medium term and is now one of the world’s largest suppliers in the market for heating, ventilation, and cooling in residential and light commercial buildings. The Power Tools division has accelerated its product development processes, thereby reducing time to market by an average of two months. As part of an innovation offensive, Power Tools plans to launch around 2,000 new products by 2027. Bosch is also systematically expanding the use of AI in all divisions. At the recent U.S. electronics trade show CES, it presented an AI-enabled high-performance computer for making the AI-controlled car cockpit a reality. By the end of 2027, the company plans to have invested a total of 2.5 billion euros in AI, which is already in use throughout the company.

Europe as a business location: Technological skepticism jeopardizes prosperity

When it comes to regional competitiveness, Bosch believes Europe has tremendous potential – provided policymakers and society can overcome the existing skepticism toward technological progress. Hartung expressed his concern regarding the latest results of the Bosch Tech Compass, a survey that reports on how people in key industrialized countries feel about new technologies. According to the survey, less than two-thirds of Germans believe that technological progress has a positive impact, and in France, the figures are even lower. “This is highly alarming,” Hartung said. “The only way a country, a society, can survive in global competition is if there is at least sufficient will to make technological progress.” To achieve this, businesses, society, and policymakers need to actively engage with new fields of technology such as hydrogen and AI with greater courage and decisiveness. As one of the most innovative companies in the world, Bosch has a role to play here. It is one of the most prolific patent applicants in Europe, having filed more than 2,000 patent applications in the field of AI alone since 2018.

Business developments in 2025: Global economy slows down sector sales

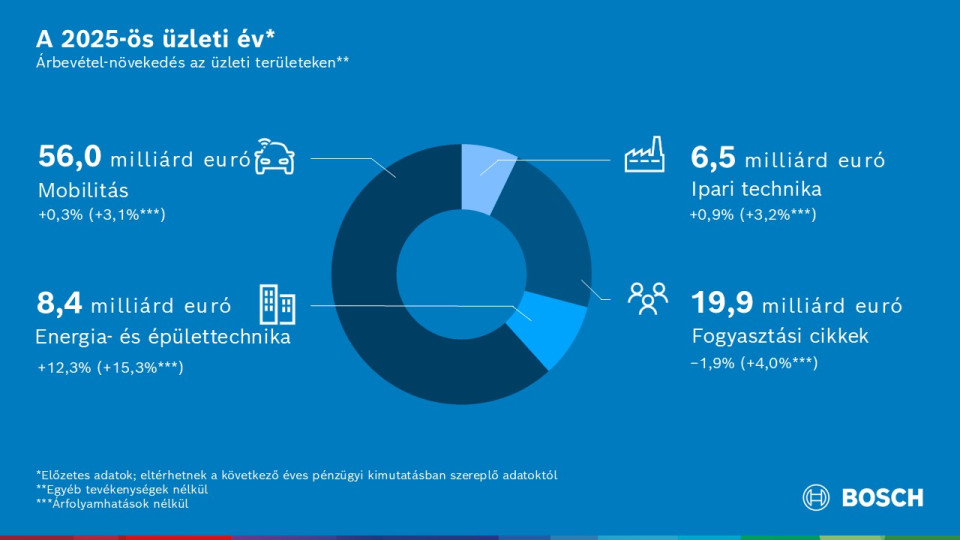

The difficult situation in various Bosch focus markets had an impact on sales development in the business sectors. “Bosch, too, clearly felt the effects of 2025’s weak global economy,” said Markus Forschner, member of the board of management and chief financial officer of Robert Bosch GmbH. “Yet despite considerable uncertainties and trade barriers, we’ve been able to hold our own in most markets.” At 56 billion euros, sales revenue in the Mobility business sector was up slightly year on year by 0.3 percent. Adjusted for exchange-rate effects, this represents an increase of 3.1 percent. The Industrial Technology business sector generated sales revenue of 6.5 billion euros; a marginal increase of 0.9 percent in sales meant it was able to maintain the previous year’s level, despite the difficult situation in the mechanical engineering and construction sectors. Adjusted for exchange-rate effects, this was an increase of 3.2 percent. In the Consumer Goods business sector, sales revenue fell by 1.9 percent to 19.9 billion euros. Adjusted for exchange-rate effects, however, it rose by 4 percent. The main reason for this development was consumers’ continuing reluctance to spend. The Energy and Building Technology business sector generated sales of 8.4 billion euros. Despite subdued construction activity, sales revenue increased year on year by 12.3 percent, or plus 15.3 percent when adjusted for exchange-rate effects. The acquisition of the HVAC solutions business more than offset the sale of the product business in the Building Technologies division.

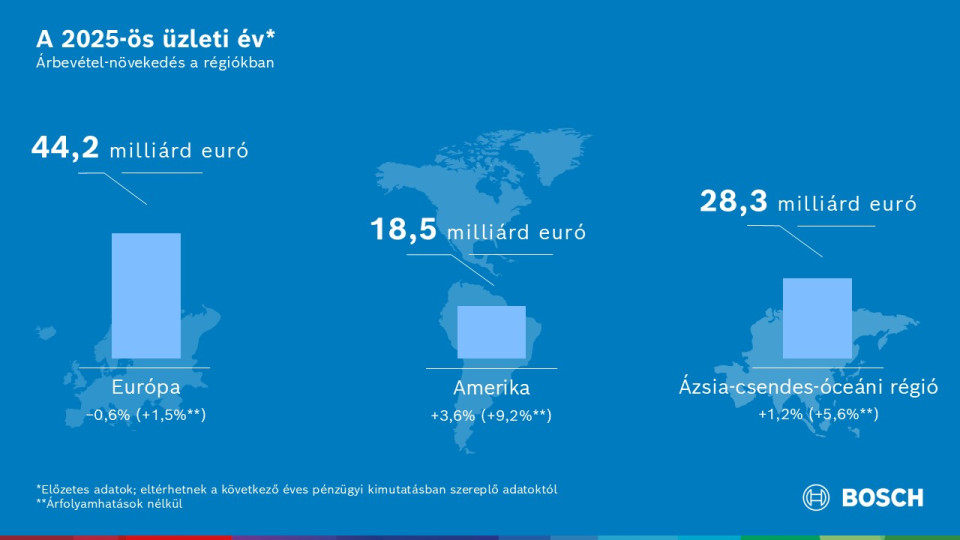

Business developments in 2025: Significant currency effects in regional sales

The challenging conditions were reflected in regional sales development as well. “The situation remained tense in all our global regions,” Forschner said. “Our business was again weakest in Europe, while the Americas and Asia Pacific were more encouraging.” In Europe, sales revenue fell slightly to 44.2 billion euros, or a nominal 0.6 percent. Adjusted for exchange-rate effects, this represents an increase of 1.5 percent. In the Americas, sales revenue increased by 3.6 percent to 18.5 billion euros. Adjusted for exchange-rate effects, this was an increase of 9.2 percent. In Asia Pacific, sales amounted to 28.3 billion euros. This is a nominal increase of 1.2 percent, or an exchange rate-adjusted 5.6 percent.

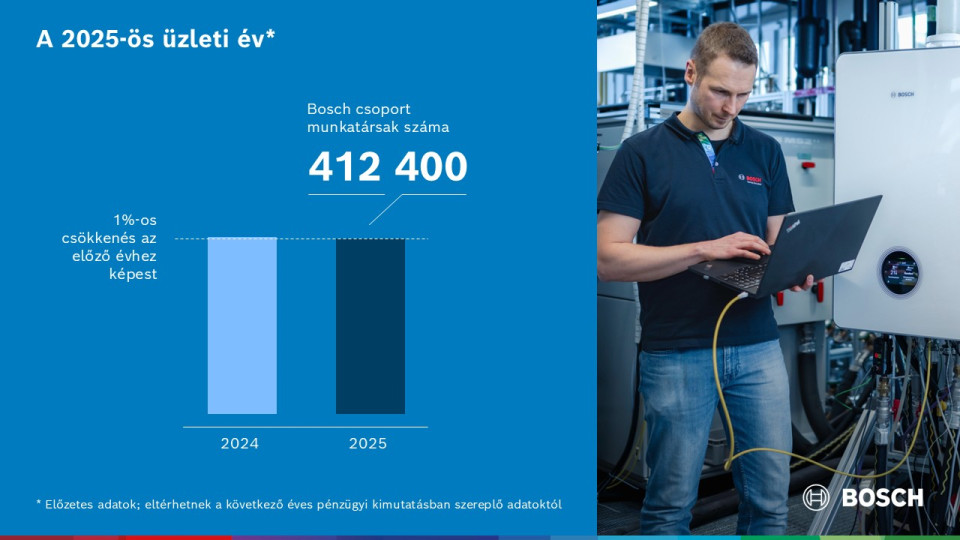

Headcount development in 2025: Headcount fell by 1 percent

Worldwide, the Bosch Group employed some 412,400 associates as of December 31, 2025; this is some 5,400 (around 1 percent) fewer than in the previous year. While the acquisition in Home Comfort added associates, the necessary job cuts and the sale of Building Technologies reduced headcount. The number of associates fell furthest in Germany, where headcount fell by around 6,500 (just under 5 percent) to a good 123,100 associates.

Outlook 2026: Competitive and price pressure continues to rise

Bosch does not expect the situation to ease in the current financial year. The company currently expects the global economy to grow by 2.3 percent in 2026. “There are many indications of a slight slowdown in global economic growth,” Forschner explained. “Competitive and price pressure are likely to increase further and the increased tariffs will have their full impact for the first time.” Bosch expects to make significant progress with the measures it introduced to implement its Strategy 2030. “We’ll begin to see positive effects on margin once we’ve improved our cost and competitive situation,” Forschner said. “But given the subdued economy and the unfavorable environment, we will achieve our target margin of 7 percent in 2027 at the earliest.” He emphasized that work on expenditures and structures is absolutely essential in order to maintain Bosch’s position in global competition and to be able to continue financing considerable upfront investments in areas of future importance. Bosch is thus laying an important foundation for the future development of the company.

Contact person for press inquiries:

Mónika Hack, e-mail: monika.hack3@hu.bosch.com

Phone: +36 70 510-5516

Corporate, business, and financial topics:

Sven Kahn, e mail: Sven.Kahn@de.bosch.com

Phone: +49 711 811 6415

Energy and building technology:

Dörthe Warnk, e mail: doerthe.warnk@de.bosch.com

Phone: +49 711 811 55508

Automated mobility:

Andreas Haupt, e mail: Andreas.Haupt@de.bosch.com

Phone: +49 711 811 13104

Connected mobility:

Athanassios Kaliudis, e mail: athanassios.kaliudis@de.bosch.com

Phone: +49 711 811 7497

Bosch Tech Compass survey:

Matthias Jekosch, e-mail: matthias.jekosch@de.bosch.com

Phone: +49 711 811 17645

Human resources and social welfare:

Kristina Müller-Poschmann, e mail: Kristina.Mueller-Poschmann@de.bosch.com

Phone: +49 711 811 52988

Nora Lenz-Gaspary, e mail: norakatharina.lenz-gaspary@de.bosch.com

Phone: +49 711 811 13315

Mónika Hack

+36 70 510 5516

Bosch has been present in Hungary since 1898 with its products. After its re-establishment as a regional trading company in 1991, Bosch has grown into one of Hungary’s largest foreign industrial employers with currently nine subsidiaries. In fiscal 2024 it had total net sales of 2058 billion forints and consolidated sales to third parties on the Hungarian market of 313 billion forints. The Bosch Group in Hungary employs more than 17,400 associates (as of December 31, 2024). In addition to its manufacturing, commercial and development business, Bosch has a network of sales and service operations that covers the entire country.

The Bosch Group is a leading global supplier of technology and services. According to preliminary figures, it employs roughly 412,000 associates worldwide (as of December 31, 2025). The company generated sales of 91 billion euros in 2025. Its operations are divided into four business sectors: Mobility, Industrial Technology, Consumer Goods, and Energy and Building Technology. With its business activities, the company aims to use technology to help shape universal trends such as automation, electrification, digitalization, connectivity, and an orientation to sustainability. In this context, Bosch’s broad diversification across regions and industries strengthens its innovativeness and robustness. Bosch uses its proven expertise in sensor technology, software, and services to offer customers cross-domain solutions from a single source. It also applies its expertise in connectivity and artificial intelligence in order to develop and manufacture user-friendly, sustainable products. With technology that is “Invented for life,” Bosch wants to help improve quality of life and conserve natural resources. The Bosch Group comprises Robert Bosch GmbH and its roughly 490 subsidiary and regional companies in over 60 countries. Including sales and service partners, Bosch’s global manufacturing, engineering, and sales network covers nearly every country in the world. Bosch’s innovative strength is key to the company’s further development. At 136 locations across the globe, Bosch employs some 82,000 associates in research and development.

The company was set up in Stuttgart in 1886 by Robert Bosch (1861–1942) as “Workshop for Precision Mechanics and Electrical Engineering.” The special ownership structure of Robert Bosch GmbH guarantees the entrepreneurial freedom of the Bosch Group, making it possible for the company to plan over the long term and to undertake significant upfront investments in the safeguarding of its future. Ninety-four percent of the share capital of Robert Bosch GmbH is held by Robert Bosch Stiftung GmbH, a limited liability company with a charitable purpose. The remaining shares are held by Robert Bosch GmbH and by a corporation owned by the Bosch family. The majority of voting rights are held by Robert Bosch Industrietreuhand KG. It is entrusted with the task of safeguarding the company’s long-term existence and in particular its financial independence – in line with the mission handed down in the will of the company’s founder, Robert Bosch.

Additional information is available online at www.bosch.hu, iot.boschblog.hu, www.bosch.com, www.iot.bosch.com, www.bosch-press.com, www.twitter.com/BoschPresse